Frequently Asked Questions

What is the standard child support percent for 1 child in texas?

The standard child support percentage for one child in Texas is 20% of the noncustodial parent's net income. This percentage is part of the Texas child support guidelines established to ensure financial support for the child's needs.

What is the standard child support order in texas?

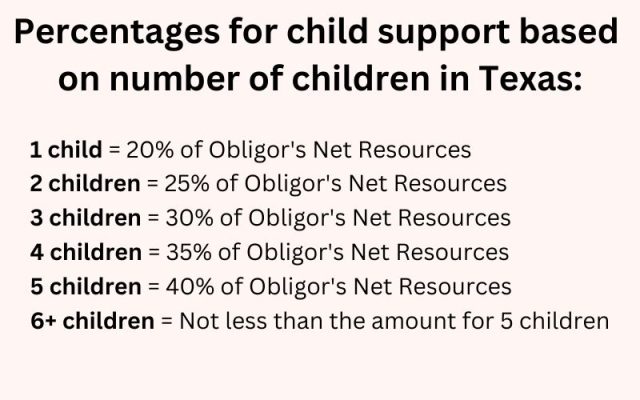

The standard child support order in Texas is typically calculated as a percentage of the non-custodial parent's income, with amounts varying based on the number of children. For one child, it's 20%, and it increases with additional children.

How to calculate standard child support texas?

Calculating standard child support in Texas involves determining the non-custodial parent’s net monthly income and applying statutory guidelines, which are based on a percentage of that income depending on the number of children to be supported.

What is the standard child support percentage in texas?

The standard child support percentage in Texas is typically based on the non-custodial parent's income, calculated as 20% of one child’s monthly income, with adjustments for additional children leading to a graduated percentage scale.

What is typical child support percentage in texas?

The typical child support percentage in Texas is based on the non-custodial parent's income, with the standard guidelines being 20% for one child, 25% for two children, and increasing percentages for more children.

What is the standard amount of child support in texas?

The standard amount of child support in Texas is typically calculated based on a percentage of the non-custodial parent's income. Generally, this equates to 20% for one child, with percentages increasing for additional children.

What is the standard child support payment in texas for 3 children?

The standard child support payment in Texas for three children is 30% of the non-custodial parent's net income, subject to adjustments based on various factors such as additional expenses or income levels.

What factors affect child support calculations in Texas?

The factors that affect child support calculations in Texas include the parents' income, the number of children, healthcare and childcare costs, and the custody arrangement. Additional considerations may include any special needs of the child and other financial obligations of the parents.

How is child support determined for one child?

Child support for one child is determined based on a percentage of the non-custodial parent's income, typically 20%, along with other factors such as healthcare costs and education expenses to ensure the child's needs are met.

What documentation is needed for child support orders?

The documentation needed for child support orders typically includes proof of income, tax returns, proof of expenses related to the child, and any previous child support agreements.

How to modify a child support agreement in Texas?

Modifying a child support agreement in Texas involves proving a substantial change in circumstances. You must file a motion with the court, providing evidence that supports the need for adjustment, and attend a hearing where a judge will make the final decision.

When does child support begin in Texas?

Child support in Texas begins from the date of the court order, which is typically established during a divorce or paternity case. Payments are usually required to start as soon as the order is issued or as specified in the order itself.

What expenses are covered by child support?

Child support covers various expenses essential for a child's well-being, including basic needs such as food, clothing, shelter, healthcare, and education costs.

How often are child support payments made in Texas?

Child support payments in Texas are typically made on a monthly basis. Parents receiving support can expect these payments to be due on the first day of each month, although specific arrangements may vary by court order.

What happens if child support is unpaid?

Unpaid child support can lead to serious consequences, including wage garnishment, tax refund interception, and even potential legal action for contempt of court. It's essential for parents to address any payment issues promptly.

Can child support be retroactively modified in Texas?

Child support can be retroactively modified in Texas under certain circumstances. Typically, modifications can affect payments going back to the date the request was filed, but not further unless specific conditions are met, such as showing a significant change in circumstances.

What are the penalties for not paying child support?

The penalties for not paying child support can include wage garnishment, tax refund interception, suspension of driver's or professional licenses, and even jail time for contempt of court.

How does income affect child support amounts?

Income significantly influences child support amounts, as the court calculates support primarily based on the parents' gross incomes, factoring in healthcare costs, other children, and additional expenses to ensure fair support for the child’s needs.

What is the process for calculating child support?

The process for calculating child support involves determining the income of both parents, considering the number of children, and applying Texas statutory guidelines to arrive at a support amount that ensures the child's needs are met.

Can child support be adjusted for job loss?

Child support can be adjusted for job loss. If a parent experiences a significant change in income due to unemployment, they can seek a modification of their child support obligation through legal channels.

What role does a lawyer play in child support?

The role of a lawyer in child support is to provide legal guidance and representation, ensuring that parents understand their rights and obligations while navigating the complexities of child support calculations and modifications.

Are child support payments tax-deductible in Texas?

Child support payments in Texas are not tax-deductible for the paying parent. Recipients do not report these payments as income either, making them non-taxable for both parties involved.

What is the procedure for receiving child support payments?

The procedure for receiving child support payments involves filing a child support order with the court, after which payments are typically received through the state's Child Support Payment Center, ensuring timely and organized disbursement.

How does joint custody impact child support amounts?

Joint custody can significantly influence child support amounts, as the custodial parent typically receives support based on the non-custodial parent's income and the time each parent spends with the child. Shared responsibilities may lead to adjustments in the support calculations.

What is the timeline for child support hearings?

The timeline for child support hearings varies, but they typically occur within 30 to 90 days after filing a petition. Factors such as court schedules and case complexity can influence the exact timing.

Are there caps on child support payments in Texas?

In Texas, there are caps on child support payments based on the noncustodial parent's income. For most cases, child support is calculated as a percentage of income, with limits set to ensure fairness in support obligations.

What resources can help with child support questions?

Resources that can help with child support questions include state websites, local family law attorneys, legal aid organizations, and family law clinics, which provide guidance on calculations, modifications, and legal rights.

How to appeal a child support determination?

The process to appeal a child support determination involves filing a notice of appeal with the court that issued the ruling, typically within 30 days of receiving the judgment. It’s advisable to consult an attorney for guidance throughout the process.

What is the difference between legal and physical custody?

The difference between legal and physical custody lies in their definitions: legal custody grants a parent the right to make important decisions regarding the child's welfare, while physical custody refers to where the child lives and spends time.

How can parents enforce child support orders in Texas?

Parents can enforce child support orders in Texas by filing a motion for enforcement in court, which may result in various actions such as wage garnishment, property seizure, or even jail time for non-compliant parents.